Construction industry receives boost – COVID-19 incentive details

Did you know that new legislation is now in place allowing for a temporary increase in the instant asset write off threshold from $30,000 to $150,000 for Australian businesses with an aggregated annual turnover of less than $500 million.

Keep in mind that this threshold increase is only valid until the 31st of DECEMBER 2020 and is not cumulative.

There are quite a few other incentives and new legilsation throughout all sectors, and we have taken the time to pull a few key initiatives together in one spot for you. If you need any more information on any of the details below – make sure you reach out to our team for up-to-date professional advice.

Instant asset Write-Offs

Increase in the instant asset write off threshold from $30,000 to $150,000, for businesses with aggregated annual turnover of less than $500 million (up from $50 million) from 12 March 2020 until 30 June 2020.

Additional depreciation Write-Off

Businesses with an aggregated annual turnover of less than $500 million will be able to deduct an additional 50 per cent of the asset cost in the year of purchase – through to 30 June 2021.

PAYG offsets

Businesses with an annual turnover of less than $50 million will be entitled to credits on their PAYG payments for the Jan to March and April to Jun activity statements equal to the amount of the payment due, capped at $50,000 for each statement (i.e. up to $100,000 in total)

PAYG variations

As a disaster response measure the ATO has advised that taxpayers can vary their monthly or quarterly PAYG instalment of income tax due on the March 2020 BAS to $nil.

The ATO has also stated: “Businesses that vary their PAYG instalment rate or amount can also claim a refund for any instalments made for the September 2019 and December 2019 quarters.”

Job Keeper wage subsidy

For businesses significantly impacted by COVID-19, the government will reimburse wages of $1,500 per fortnight per employee for each employee on the books of a business at 1 March 2020. Businesses need to demonstrate an income decline of at least 30% to be eligible. Payments will begin in May but will be backdated to 1 March 2020. Businesses need to register their interest in the scheme on the Australian Taxation Office website.

New South Wales

Payroll tax-paying businesses with a payroll of less than $10 million are not required to make payroll tax payments for the months of March, April, or May 2020. (All dollar figures expressed are Australian dollars.) For these businesses, all wages paid should still be disclosed in the annual reconciliation, however a 25-percent reduction in the amount of tax the business would have had to pay for the year ended 30 June 2020 will be applied. Details are expected shortly with respect to the process for claiming the waiver (if required).The NSW payroll tax threshold will also be increased to from $900,000 to $1 million, from 1 July 2020.

Victoria

The government will provide full payroll tax refunds for the 2019-20 financial year to small- and medium-sized businesses with payroll of less than $3 million. This assistance is a refund, not a loan. The same businesses will also be able to defer any payroll tax for the first three months of the 2020/21 financial year until 1 January 2021.

Queensland

Payroll tax-paying businesses with a payroll of up to $6.5 million, will receive an email about a refund of payroll tax for two months and a payroll tax holiday for three months. These businesses can also apply for a deferral of payroll tax for the rest of the 2020 calendar year (deferral requests already applied for will be automatically extended). Payroll tax-paying businesses with a payroll above $6.5 million, who are negatively affected by COVID-19 can apply for a deferral of payroll tax for the 2020 calendar year (deferral requests already applied for will be automatically extended) and a refund of payroll tax for two months. The deferral and refund are granted by a separate application. The refund must be applied for before 31 May 2020.

Western Australia

Payroll tax-paying businesses with a payroll between $1 million and $4 million will receive a grant of $17,500 to assist them with managing the impacts of COVID-19. The grants will be issued by cheque to eligible taxpayers in July 2020 (no application necessary). Additional payroll tax relief will also apply for small businesses as a result of the payroll tax threshold increasing to $1 million from 1 July 2020 (six months earlier than planned). There is also a payroll tax payment deferral available for businesses a payroll of $7.5 million or less that are impacted by COVID-19. The deferral is granted by application4 and applies to the period between 1 March and 30 June. Payroll tax returns for these periods are still required to be lodged where payment deferral is granted.

Tasmania

A payroll tax waiver is being provided for employers in the hospitality, tourism, and seafood industries during 2020 for the March, April, and May 2020 months. These organisations will still be required to lodge their annual payroll tax reconciliations by 21 July 2020, and a waiver of payroll tax will be granted for March, April, May, and June. A payroll tax waiver is also being provided for with a payroll of up to $5 million during 2020 for the March, April and May 2020 months. These organisations will still be required to lodge their annual payroll tax reconciliations by 21 July 2020 and a waiver of payroll tax will be granted for March, April, and May. To encourage businesses to employ young people, the government will introduce a youth employment payroll tax rebate scheme for young people from 1 April 2020. The scheme provides a payroll tax rebate for one year, to businesses that employ a young person aged 24 and under.

ACT

Six month waiver on payroll tax for hospitality, creative arts and entertainment industries. Access to interest free deferrals of payroll tax commencing 1 July 2020 for all businesses up to a payroll threshold of $10 million.

Earth Drills

Earth Drills  Hitches & Frames

Hitches & Frames  Augers & Extensions

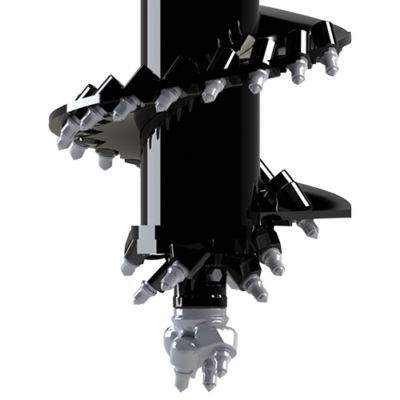

Augers & Extensions  Screw Pile Torque Heads

Screw Pile Torque Heads  Hard Rock Augers

Hard Rock Augers  Trenchers

Trenchers  Variable Mulchers

Variable Mulchers  TC Range Mulchers

TC Range Mulchers  Hedge Trimmer

Hedge Trimmer  Cone Crusher Bucket

Cone Crusher Bucket  Drum Cutters

Drum Cutters  Log Splitter

Log Splitter  Stump Planer

Stump Planer  Cement Mixer Bowls

Cement Mixer Bowls  Pallet Forks

Pallet Forks